The Ghanaian economy has undergone its most severe crisis in a generation during the past two years. This crisis, stemming from pre-existing fiscal and debt vulnerabilities, was intensified by external factors, compelling the government to seek assistance from the International Monetary Fund (IMF). This brief essay offers an analysis of the economic landscape as of the end of 2023, drawing on publicly available data sources. The discussion encompasses various aspects, including economic growth, interest rates, exchange rates, international reserves, and consumer and business confidence.

I previously wrote about Ghana’s current disinflation path here so this essay deliberately doesn’t discuss inflation to avoid repetition. As a recap of that, Ghana is currently progressing along a favorable disinflation path, and given effective risk mitigation measures, this trajectory is anticipated to persist.

So back to our main focus, let’s start with economic growth.

Economic growth

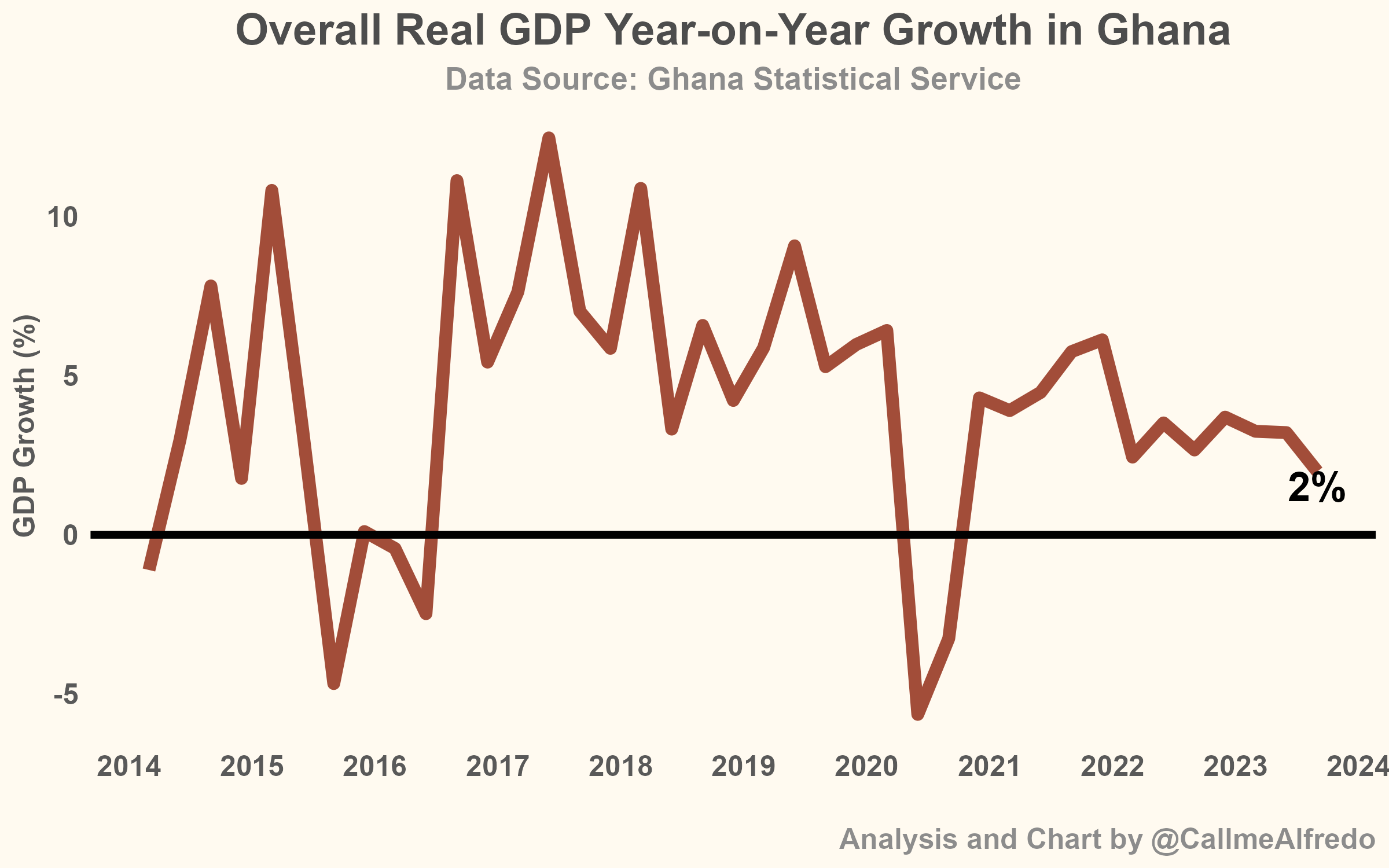

Ghana’s economic growth in the third quarter of 2023 registered a disappointing rate of 2%. This represents a decline compared to the average economic growth of 3.2% observed in the first half of the year. Strikingly, the third-quarter growth in 2023 was even lower than the 2.7% recorded during the height of the economic crisis in 2022. The primary contributor to this subdued growth was the persistent struggle within the industrial sector, which posted negative growth for the fourth consecutive quarter.

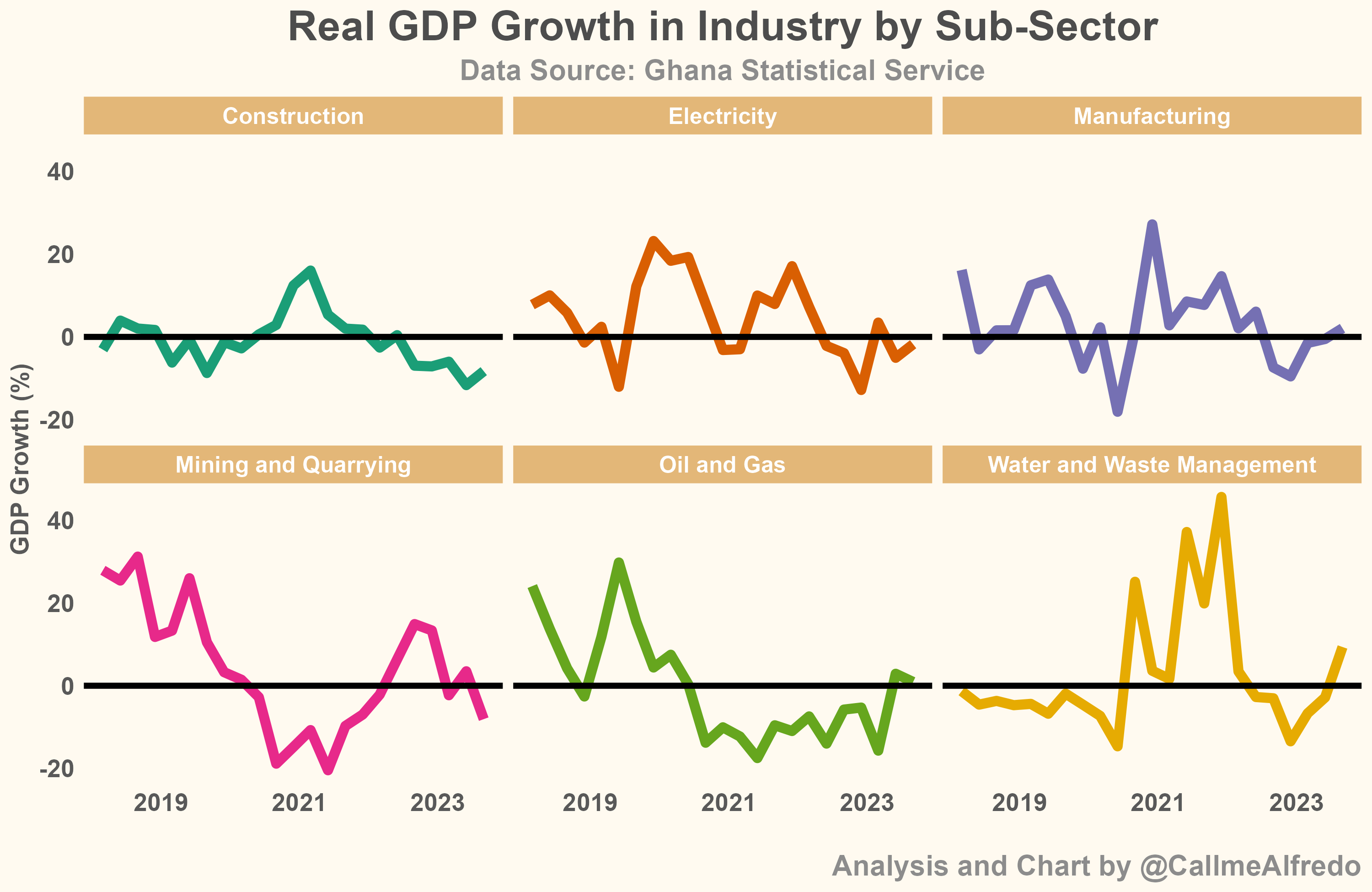

Ghana’s industry sector continues to struggle to recover to growth levels seen before the pandemic. Growth is currently 4.2% below its pre-pandemic level. The two other sectors, agriculture and services, are currently growing at 26.5% and 21.3%, respectively above pre-pandemic levels. Industrial sub-sectors struggling to grow include construction, mining and quarrying, and industry demand of electricity.

Ghana’s industry sector continues to struggle to recover to growth levels seen before the pandemic. Growth is currently 4.2% below its pre-pandemic level. The two other sectors, agriculture and services, are currently growing at 26.5% and 21.3%, respectively above pre-pandemic levels. Industrial sub-sectors struggling to grow include construction, mining and quarrying, and industry demand of electricity.

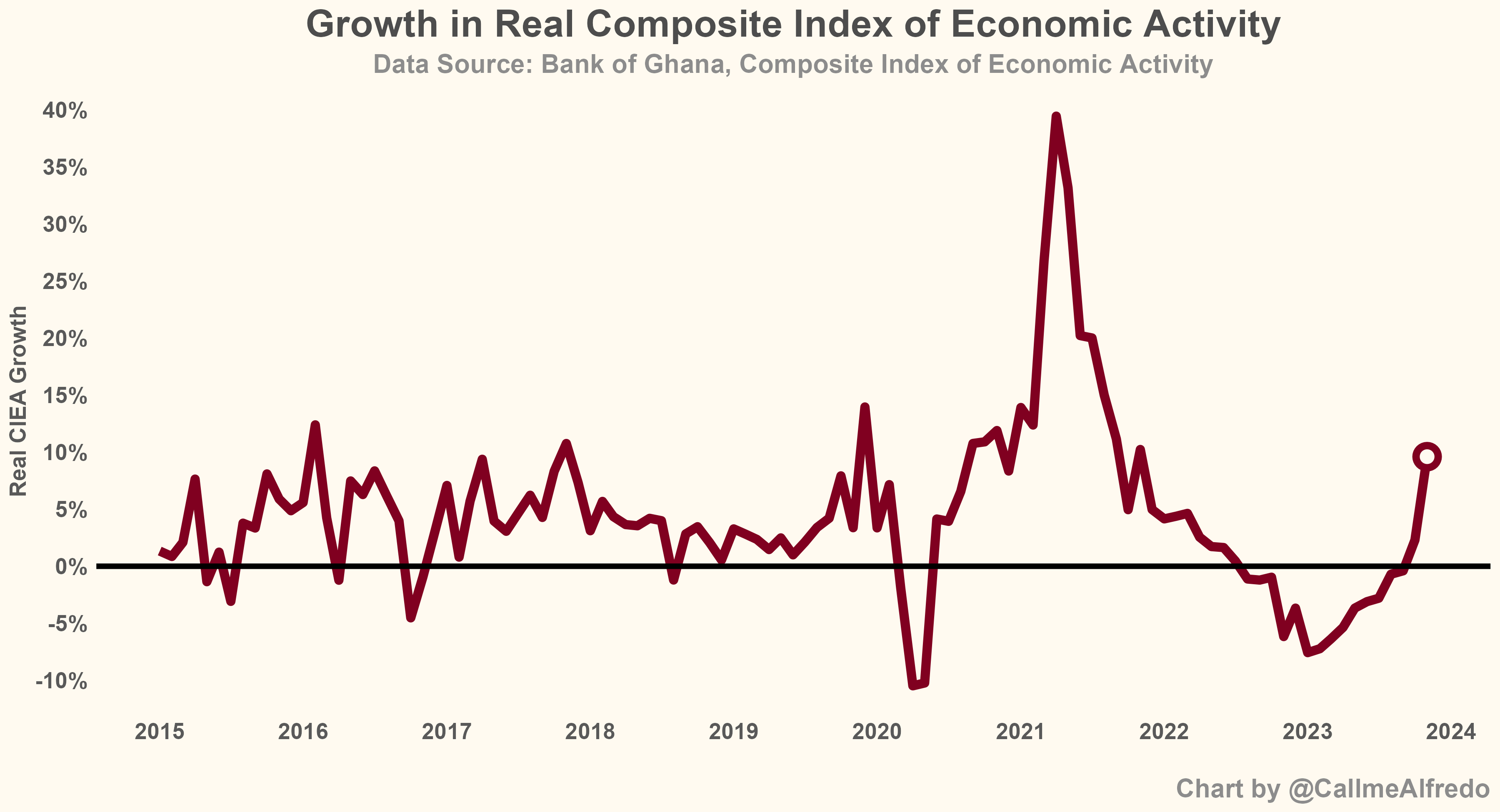

An additional metric that serves as a crucial gauge of economic activity is the Bank of Ghana’s Composite Index of Economic Activity (CIEA). This composite index amalgamates various indicators such as retail sales, port activity, cement sales, imports, exports, tourist arrivals, credit to the private sector, industrial consumption of electricity, and job advertisements into a singular measure, tracking its fluctuations over time.

Following an extended period of negative growth lasting over a year, the real CIEA recorded a positive growth in October and November of 2023. This was as a result of increased levels of cement sales, increased domestic VAT collection, a rise in passenger arrivals, and an upsurge in job advertisements during the period.

Despite the underwhelming growth observed in GDP during the third quarter of 2023, the resurgence of the Composite Index of Economic Activity (CIEA) in the first two months of the fourth quarter indicates a potential rebound in GDP for Q4. We will await the official release of Q4 GDP data by the Ghana Statistical Service in the coming weeks.

Interest rate and private sector credit

Interest rate

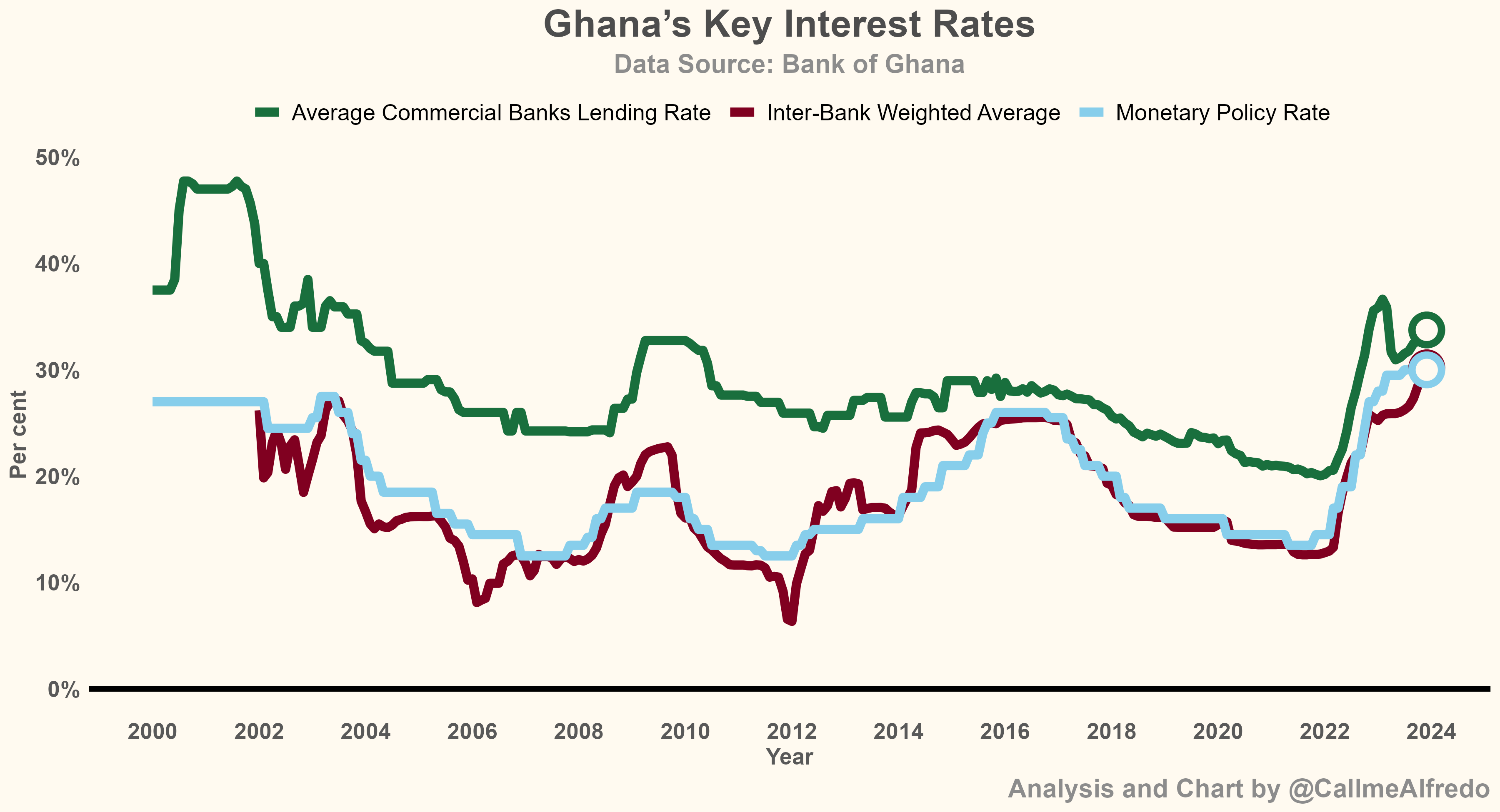

The cost of borrowing remains considerably high in Ghana, with the central bank steadfastly maintaining its key policy rate at 30% since July 2023 in an effort to curb inflation. For what it’s worth, I don’t anticipate that the CB would reduce the policy rate when it announces its decision on January 29th.

The interbank weighted average interest rate, which is simply the rate at which commercial banks lend to each other, reached 30% in December 2023. In the same period last year, at the peak of the economic crisis, the rate was 25%.

Finally, and likely the most important interest rate to you as a reader is the commercial bank lending rate. That is the rate at which commercial banks lend money to you. The average lending rate actually reduced by 1.8 percentage points between December 2022 and December 2023.

Credit to the private sector

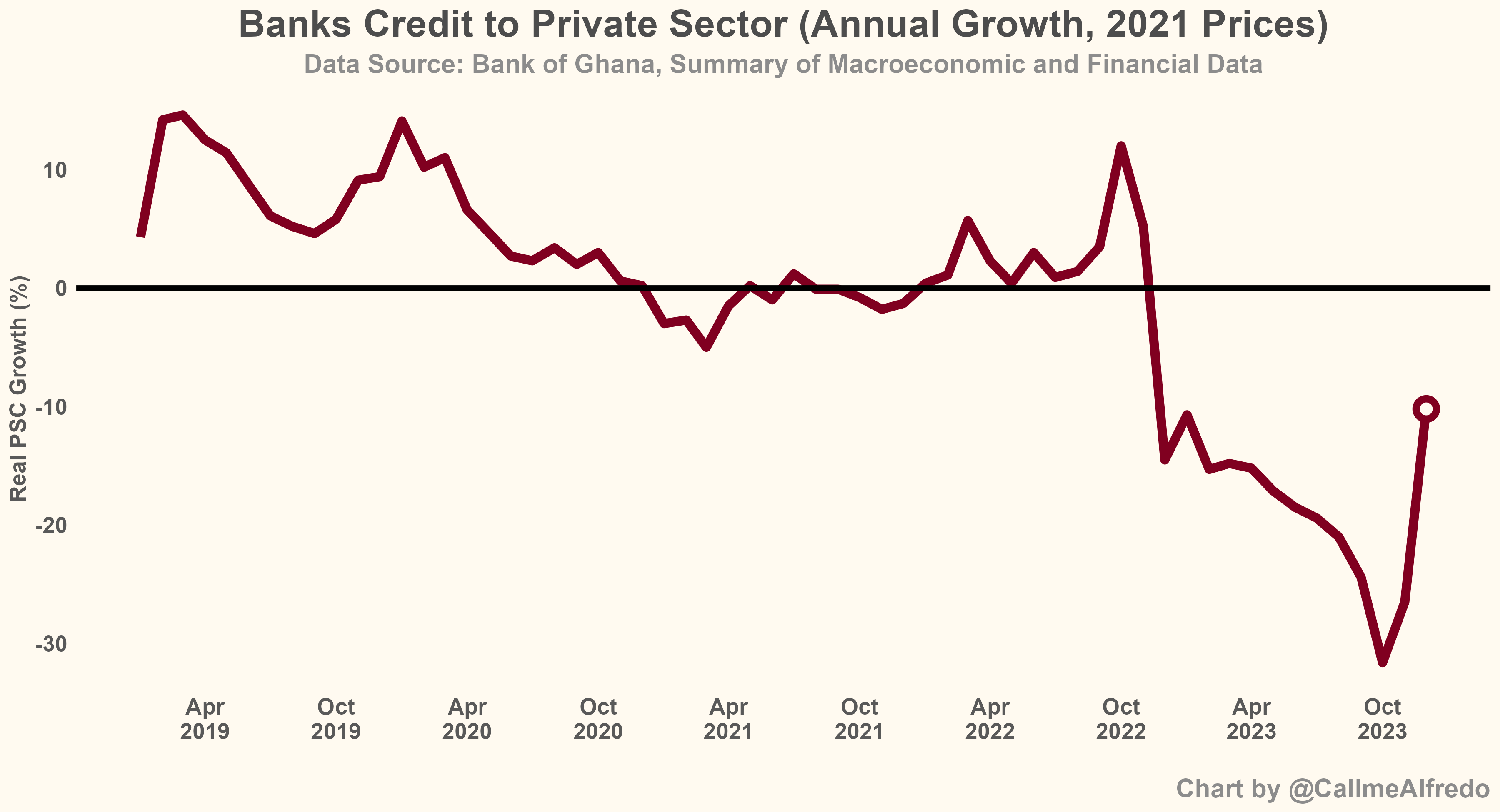

The deterioration in the macroeconomic environment has undeniably influenced the risk perceptions of banks, leading to a heightened aversion to lending to the private sector. This increasing risk aversion is evident in the negative trajectory of private sector credit growth (adjusted for inflation) since December 2022, reaching a peak decline of -32% in October 2023. Throughout 2023, private sector credit to GDP ratio remained stagnant at around 8%, a decrease from the 10% recorded in the previous year.

However, with some promising signs of a recovery in the macroeconomic landscape, there was an improvement in December 2023. The decline in credit to the private sector was 10%, marking the lowest decrease observed in the past 13 months. This shift suggests a potential easing of banks’ risk perceptions and a gradual return to a more favorable lending environment for the private sector.

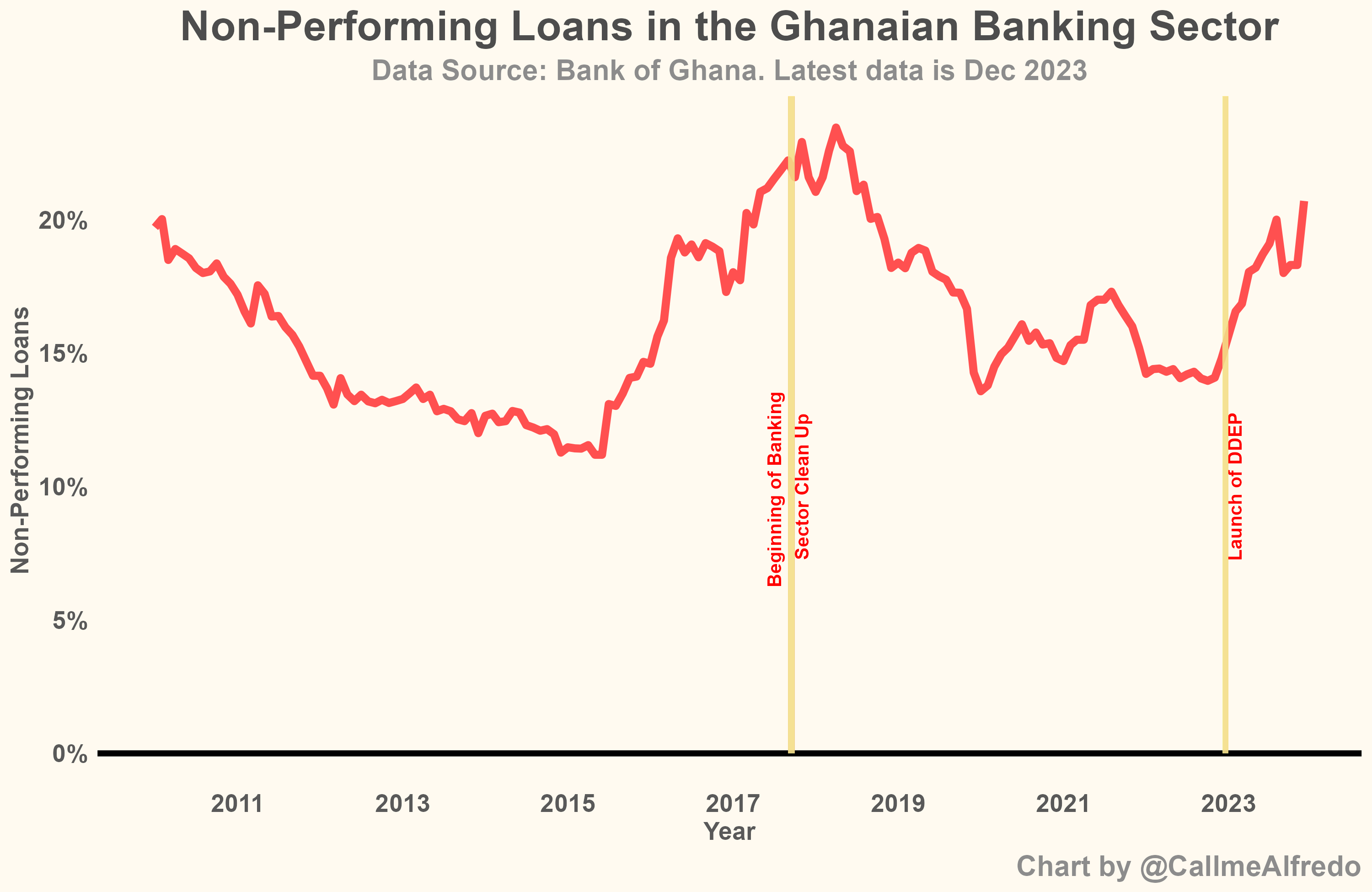

The challenging lending market is further exacerbated by the increasing stock of non-performing loans in the banking sector. By December 2023, the ratio of non-performing loans had surged to 21%, which is a concerning trend.

Foreign exchange and international reserves

Exchange rate

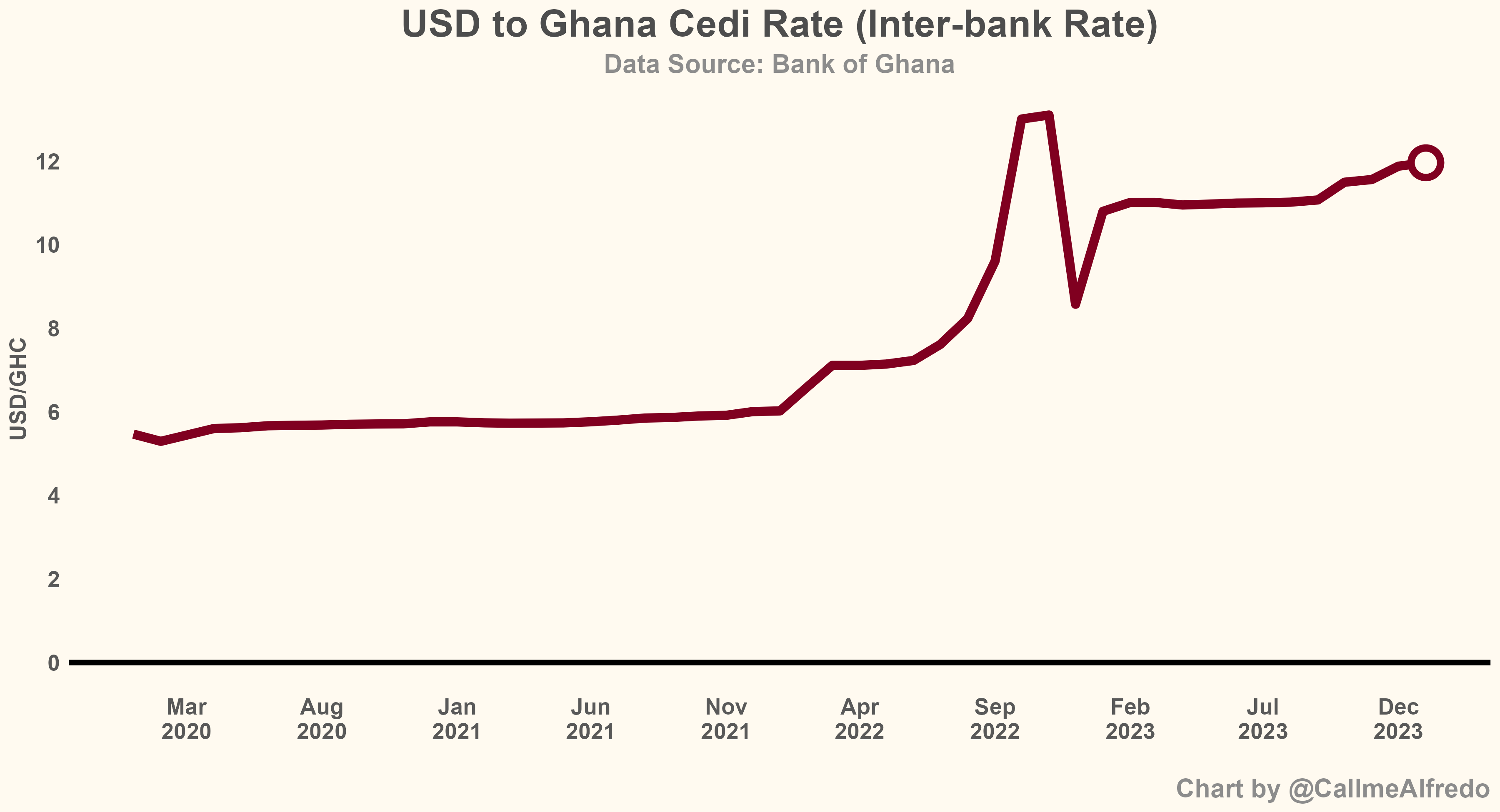

The Ghanaian cedi has experienced a degree of stability in relation to the US dollar over the past year. In December 2023, it recorded a year-to-date depreciation of 28%, a marginal improvement from the 30% depreciation during the corresponding period in 2022. However, it is essential to note that the currency’s value has undergone a substantial deterioration when compared to pre-pandemic levels or even the period preceding the current economic crisis.

International reserves

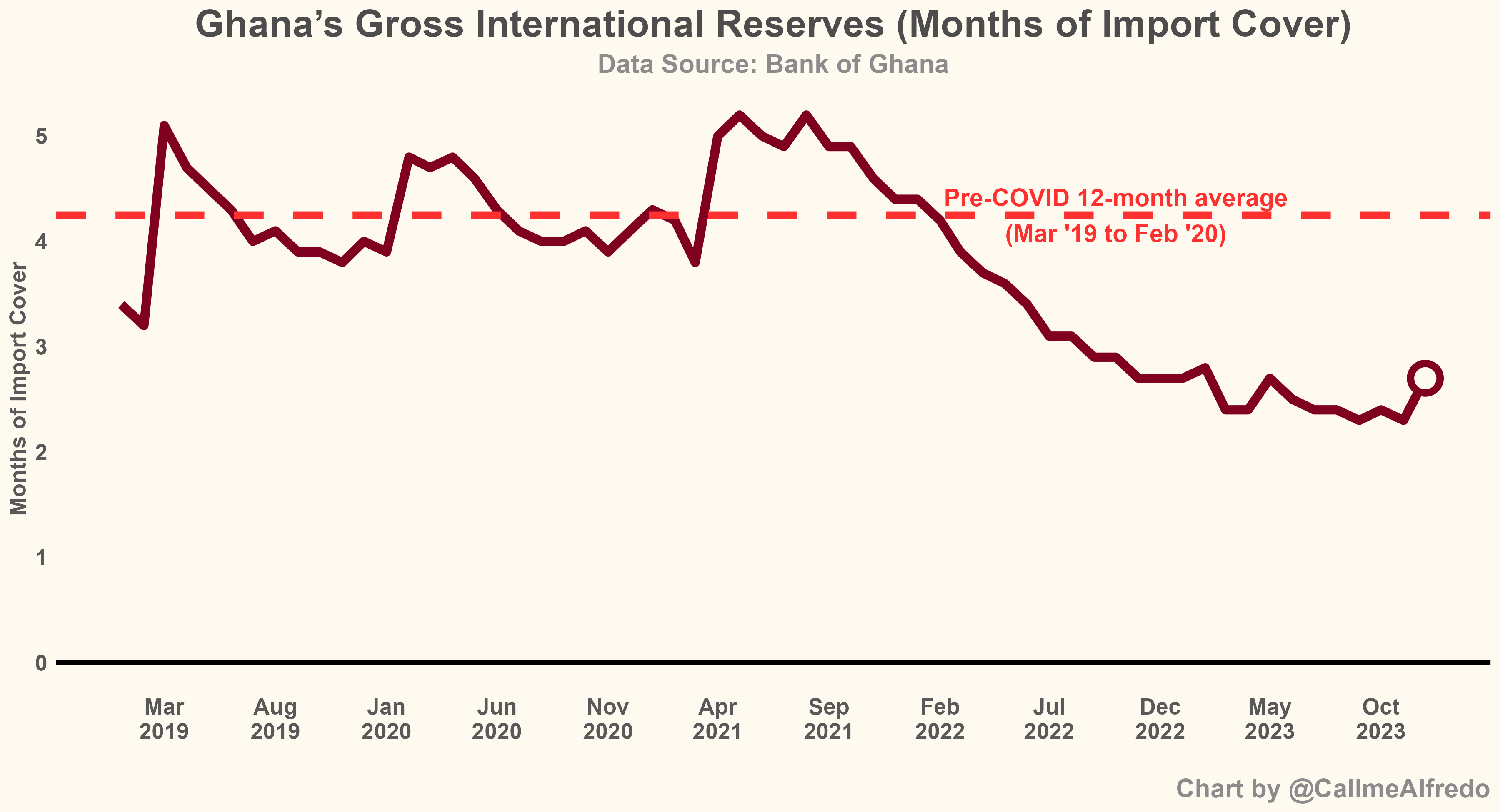

International reserves, which are reserve funds that central banks can exchange among themselves, play a crucial role in supporting international transactions between countries.

In the twelve months before the onset of COVID-19, Ghana maintained gross international reserves equivalent to 4.3 months of import cover. However, following the loss of access to international capital markets in 2022, Ghana’s international reserves experienced a decline, reaching a low of 2.3 months of import cover. In December 2023, there was a modest improvement, bringing international reserves to 2.7 months of import cover.

Looking ahead, I anticipate that recent inflows from the International Monetary Fund (IMF) and the World Bank will contribute to a further enhancement of Ghana’s international reserves in the near term.

Consumer confidence

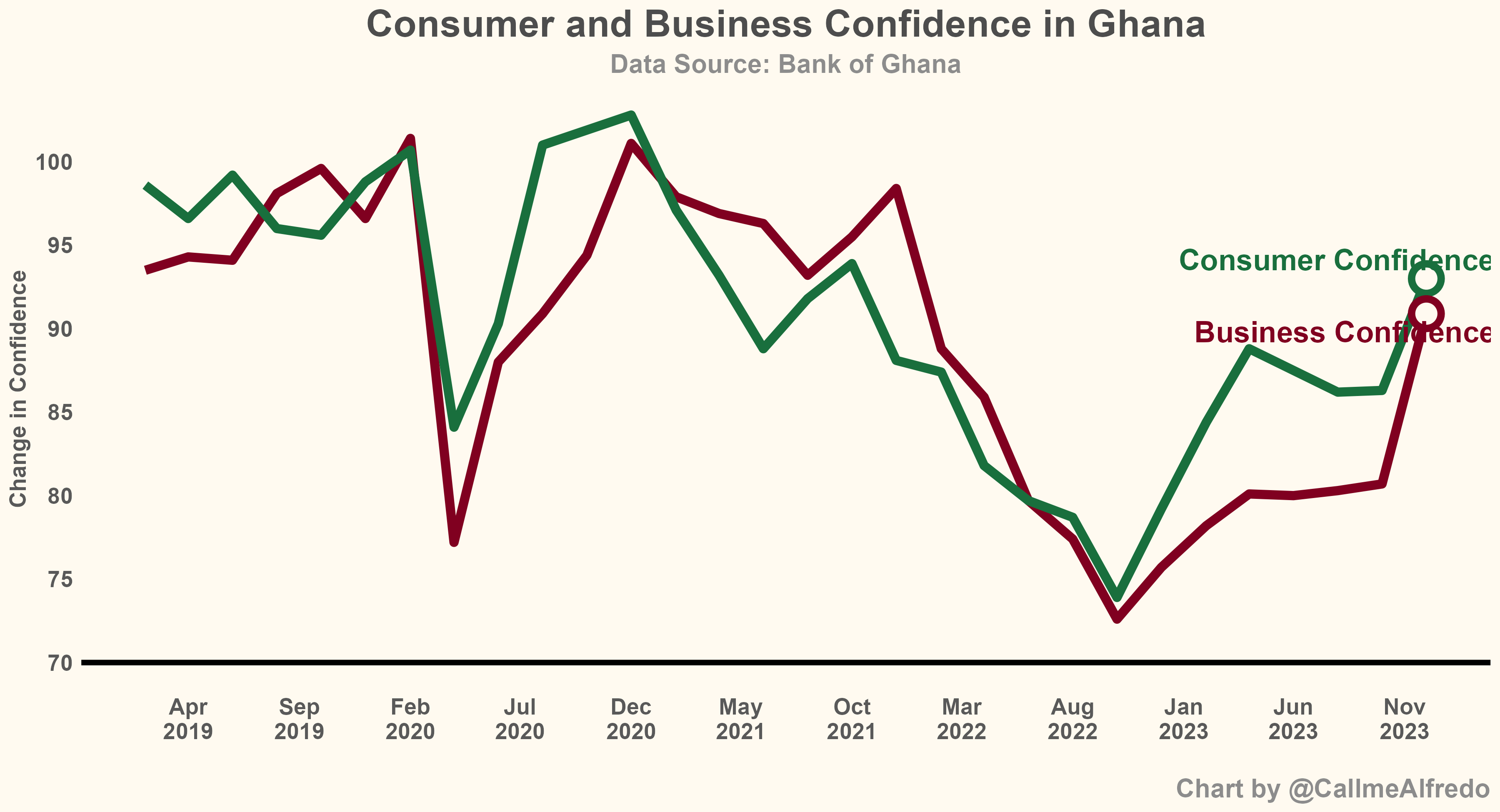

The Bank of Ghana tracks perceptions of consumers and businesses on the economy using confidence surveys. It then constructs a consumer confidence index and a business confidence index from the surveys.

Over recent periods, there has been substantial declines in consumer and business confidence, reflecting the macroeconomic environment. However, in December 2023, a positive shift occurred, with both consumer and business confidence reaching their highest points in the past 13 reporting periods. These changes could potentially signify growing optimism, possibly influenced by the anticipated positive impact of inflows from the International Monetary Fund (IMF) and the World Bank on the macroeconomic environment.

Final note

The current state of the Ghanaian economy presents a mixed picture marked by both positive and challenging indicators. While GDP growth in the third quarter was disappointing, there are signs of a potential economic rebound in the fourth quarter. Notably, the Composite Index of Economic Activity (CIEA) showed positive growth in October and November, driven by increased cement sales, VAT collection, and other factors. The central bank’s efforts to control inflation have maintained a high policy rate of 30%, contributing to elevated borrowing costs. On the currency front, the Ghanaian cedi showed relative stability against the US dollar, albeit with notable year-to-date depreciation. The banking sector faces challenges with a rising ratio of non-performing loans and residual effects of the domestic debt exchange program, influencing credit risk.

However, there are positive signals, including increases in consumer and business confidence, possibly fueled by anticipated improvements from inflows provided by the IMF and the World Bank. International reserves, though recovering, remain below pre-crisis levels. Overall, the Ghanaian economy has a long road to full recovery and policymakers must remain focused. Elections remain a key risk to the outlook on the fiscal policy side and how we navigate that would improve or further disrupt the path to recovery.